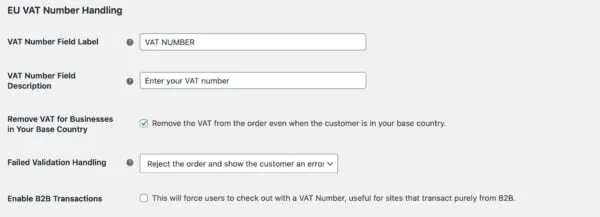

WooCommerce EU VAT Number Nulled numbers at checkout and remove the VAT charge for eligible EU businesses.

- Exempt businesses from paying VAT (Value Added Tax), if necessary;

- Collect and validate user location in B2C transactions;

- Handle EU Tax requirements for digital goods;

- Collect and validate EU VAT numbers at Checkout;

This extension provides your checkout with a field to collect and validate a customer’s EU VAT Nulled number if they have one. Upon entering a valid VAT number, the business will not be charged VAT at your store.

Changelog

Version 2.9.11Released on 2024-12-04

- Change the priority of our `init` method that is hooked to `plugins_loaded` from the default 10 to 9, ensuring it always fires before `woocommerce_blocks_loaded`.

- Bump WooCommerce “tested up to” version 9.5.

- Bump WooCommerce minimum supported version to 9.3.

version 2.9.10Released on 2024-11-18

- Bump WordPress “tested up to” version 6.7.

Version 2.9.9 Released on 2024-11-04

- Issue with charging VAT when base country is France and buyer’s country is Monaco.

- Ensure that VAT is calculated properly in the admin for virtual orders when tax calculation and VAT validation are based on the shipping address.

![(v1.7.8 ) WooCommerce Private Store Nulled [Barn2 Media]](https://nullgrab.com/wp-content/uploads/2024/11/WooCommerce-Private-Store-Barn2-218x150.png)